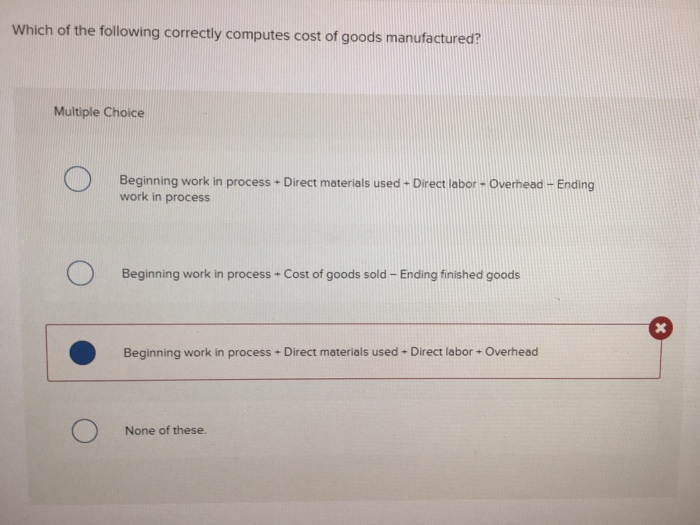

Which of the following correctly computes cost of goods manufactured? This is a question that arises frequently in the realm of accounting and financial reporting. Understanding the accurate calculation of cost of goods manufactured (COGM) is crucial for businesses to assess their profitability and make informed decisions.

The significance of COGM lies in its role as a fundamental component of the income statement. It represents the direct costs incurred in the production of goods, including raw materials, labor, and manufacturing overhead. By accurately determining COGM, businesses can gain insights into their production efficiency, cost structure, and overall financial performance.

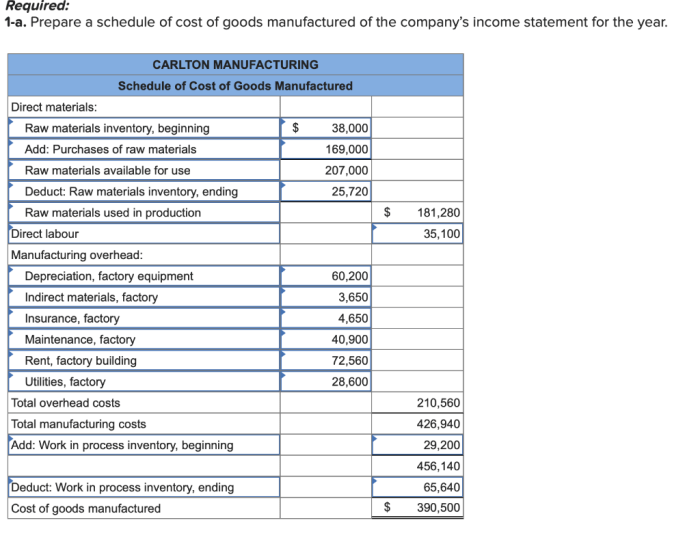

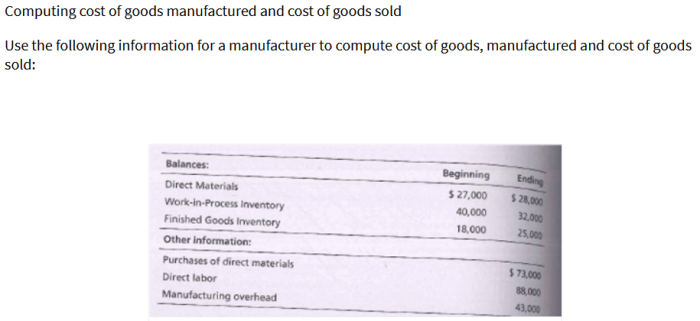

Compute Cost of Goods Manufactured

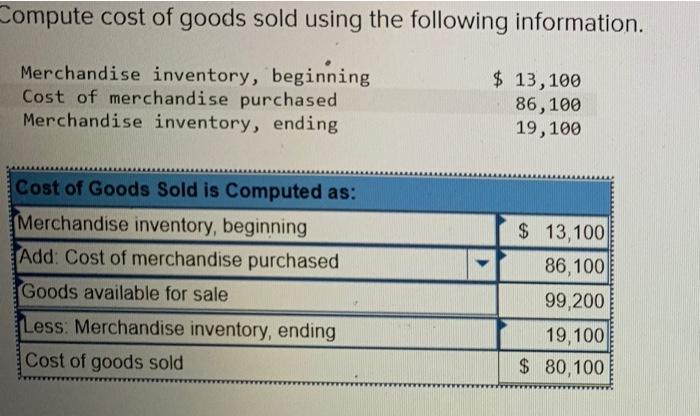

The cost of goods manufactured (COGM) is a crucial financial metric that represents the direct costs associated with producing a company’s products. It is calculated using the formula:

COGM = Beginning Inventory + Purchases

Ending Inventory

COGM plays a significant role in financial reporting as it directly impacts the determination of a company’s gross profit and net income.

Methods for Calculating COGM

There are several methods used to calculate COGM, each with its own advantages and disadvantages:

- Specific identification method:Each unit of inventory is tracked individually, and the cost of goods sold is determined by the actual cost of the units sold.

- First-in, first-out (FIFO) method:Assumes that the first units purchased are the first units sold, regardless of their actual physical flow.

- Last-in, first-out (LIFO) method:Assumes that the last units purchased are the first units sold.

- Weighted average cost method:Calculates the average cost of all units in inventory, regardless of when they were purchased.

Factors Affecting COGM

Several factors can affect COGM, including:

- Production costs:The costs associated with manufacturing the product, such as raw materials, labor, and overhead.

- Material costs:The cost of the raw materials used in production.

- Labor costs:The wages and benefits paid to employees involved in production.

- Overhead costs:The indirect costs associated with production, such as rent, utilities, and depreciation.

Changes in these factors can impact COGM, which in turn can affect a company’s profitability.

COGM and Financial Analysis

COGM plays a crucial role in financial analysis as it is used in:

- Inventory management:To determine the optimal level of inventory to hold.

- Profitability analysis:To calculate gross profit and net income.

- Cash flow analysis:To assess the impact of inventory changes on cash flow.

By analyzing COGM, companies can make informed business decisions related to production, inventory management, and pricing.

COGM in Different Industries

The calculation and use of COGM can vary across different industries:

- Manufacturing:COGM is typically a significant component of the cost of goods sold due to the high production costs.

- Retail:COGM is calculated based on the cost of inventory purchased and sold, including transportation and storage costs.

- Service:COGM may not be directly applicable as service companies do not produce physical goods.

Understanding the unique challenges and considerations for calculating COGM in each industry is essential for accurate financial reporting.

Detailed FAQs: Which Of The Following Correctly Computes Cost Of Goods Manufactured

What is the formula for calculating COGM?

COGM = Beginning Inventory + Purchases – Ending Inventory

What are the different methods used to calculate COGM?

Specific identification method, First-in, first-out (FIFO) method, Last-in, first-out (LIFO) method, Weighted average cost method

What factors can affect COGM?

Production costs, Material costs, Labor costs, Overhead costs